36+ 15 year biweekly mortgage calculator

Current 5-Year Hybrid ARM Rates. 15 Year Amortization Schedule is a loan calculator to calculate monthly payment for your fixed interest rate 15-year loan with a 15 year mortgage amortization schedule excel.

Pin On Templates

26 times per year.

. Cash Out Mortgage Refinancing Calculator. A 15-year fixed-rate. Mortgage interest rates are always changing and there are a lot of factors that.

Biweekly mortgage calculator with extra payments excel to calculate your mortgage payments and get an amortization schedule in excel xlsx xls or pdf format. Current Remaining Mortgage Principal Calculator. This results in savings of in.

The first calculator figures monthly home payments for 30-year loan terms. 52 times per year. Here are some of the advantages of a 15-year mortgage over a 30-year mortgage.

Across the United States 88 of home buyers finance their purchases with a mortgage. Second mortgage - 5 10 or 15 year term. To help you see current market conditions and find a local lender current Redmond mortgage refinance rates are published in a table below the calculator.

Your EFCU account must be in good standing and have been opened for at least 30 days. If no results are shown or you would like to compare the rates against other introductory periods you can use the products menu to select rates on loans that reset after 1. Free loan calculator to find the repayment plan interest cost and amortization schedule of conventional amortized loans deferred payment loans and bonds.

365 times per year. Terms Conditions - SAFE Loan. For people with alternating work schedules like doctors or nurses to calculate their.

If no results are shown or you would like to compare the rates against other introductory periods you can use the products menu to select rates on loans that reset after 1 3 5 or 7 years. Current 10-Year Hybrid ARM Rates. Defaulting on a mortgage typically results in the bank foreclosing on a home while not paying a car loan means that the lender can repossess the car.

Build home equity much faster. Furthermore compared to a 30-year FRM you save tens and thousands on interest charges with a 15-year FRM. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term.

If a person. The table below compares a 30-year fixed mortgage with a 15-year fixed mortgage. 15-year FRMs also come with lower rates by around 025 to 1 than 30-year FRMs.

The average interest rate for the most popular 30-year fixed mortgage is 548 according to data from SP Global. Hourly Wages to Convert Amount. By default 312500 15-yr fixed-rate refinance loans are displayed in the table below.

Calculation assumes a fixed mortgage rate. 15 Year Mortgage Calculator 30 Year. Be sure to select the correct frequency for your payments to calculate the correct annual income.

1095 days 36 month Certificate. As of January 10 2021 the average mortgage rate for a 30-year FRM is 265 APR while the average interest rate for a 15-year FRM is 216 APR. Biweekly Mortgage Calculator Weekly.

The biweekly loan calculator has a biweekly amortization schedule excel that breaks down all the payment details. You can use our 15 year calculator to see how much you would need to pay each month to extinguish your loan in 15 years then try to regularly. Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan.

Biweekly mortgage calculator with amortization schedule is a home loan calculator to calculate biweekly payments for your mortgage. A biweekly mortgage has payments made every two weeks instead of monthly. I am getting a loan for 15 years but I am not paying anything during initial 2 years.

Biweekly payments accelerate your mortgage payoff by paying 12 of your normal monthly payment every two weeks. 24 times per. The biweekly payments option is suitable for.

Use our free mortgage calculator to estimate your monthly mortgage payments. 15 Year Mortgage Calculator 30 Year Mortgage Calculator Condo. Loan 30-Year 15-Year.

While both loan types have similar interest rate profiles the 15-year loan typically offers a slightly lower rate to the 30-year loan. Biweekly Mortgage Calculator Weekly Amortization. And since your DTI is low youre entitled to a more favorable.

For a biweekly payment a 30-year term is multiplied by 26 resulting. Free mortgage payoff calculator to evaluate options to pay off a mortgage earlier such as extra payments bi-weekly payments or paying back altogether. The most common mortgage in Canada is the five-year fixed-rate closed mortgage as opposed to the US.

The following table shows the rates for ARM loans which reset after the tenth year. Please i need a loan amortization excel sheet that has biweekly repayment. The share fell from 96 to 66 while that of banks and other institutions rose from 3 to 36.

You can use our biweekly mortgage calculator to estimate how much you can save. Where the most common type is the 30-year fixed-rate open mortgage. In this example if you apply for a mortgage with your spouse your front-end DTI ratio will be 2053 and your back-end DTI ratio will be 3417.

Or one extra month of payments every year. Account for interest rates and break down payments in an easy to use amortization schedule. The maximum amortization for a default insured mortgage is 25 years.

Filters enable you to change the loan amount duration or loan type. People typically move homes or refinance about every 5 to 7 years. Car Loan Calculator.

Payoff in 15 years and 8 months. Hours a day alternatively 3 days one week 4 days the next week. Actual mortgage rates may fluctuate and are subject to change at any time without notice.

Please do not rely on this calculator results when making financial decisions. 1460 days 48 month Certificate. 9 years and 4 months earlier.

This simple technique can shave years off. This calculator shows you possible savings by using an accelerated biweekly mortgage payment. For example a loan with a 3 APR charges 003 per year or dividing that by 12 00025 per month.

If your lenders DTI limit is 28 for front-end DTI and 36 for back-end DTI you have a good chance of qualifying for a mortgage. 7340 Biweekly or 3027 Weekly. Please visit your branch or speak to a mortgage specialist.

By the end of each year you will have paid the equivalent of 13 monthly payments instead of 12. 5 Year Amortization Schedule is a loan calculator to calculate monthly payment for your fixed interest rate 5-year loan. The following table shows the rates for ARM loans which reset after the fifth year.

That could make their work schedule alternate between 36 hours and 48 hours each week. In this calculator you can inclue investments annuities alimony government benefit payments in the other income sources. For example a 30 year mortgage will not be paid off in 30 years with extra fees being thrown onto it UNLESS those fees are also automatically included in the payment amount.

You can change the loan term or any of the other inputs and results will automatically calculate.

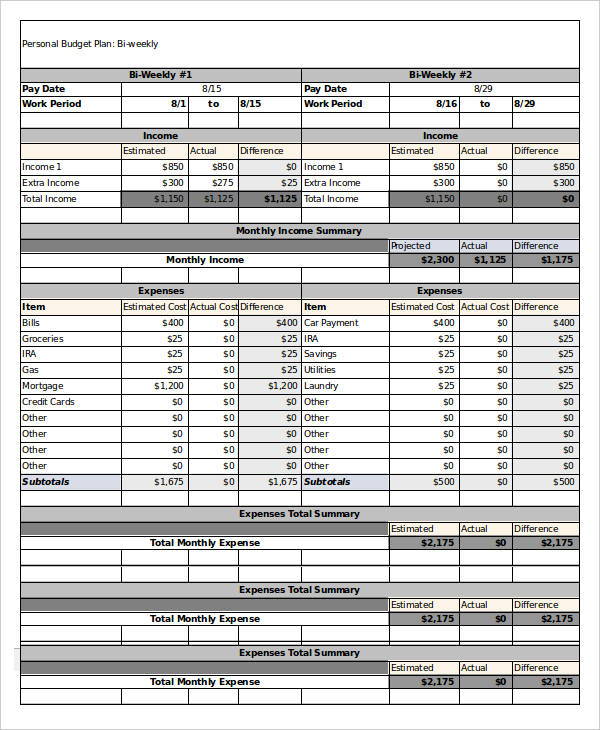

Biweekly Mortgage Calculator With Extra Payments Free Excel Template Mortgage Amortization Calculator Mortgage Loan Calculator Mortgage Payment Calculator

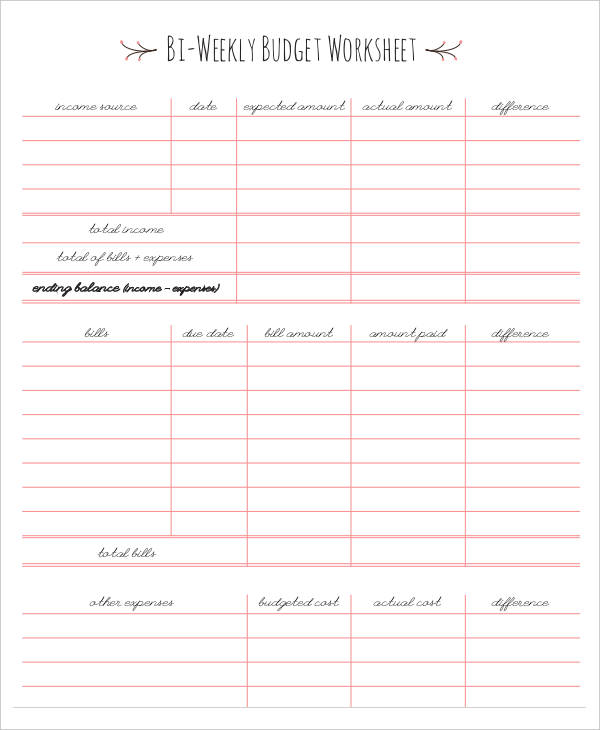

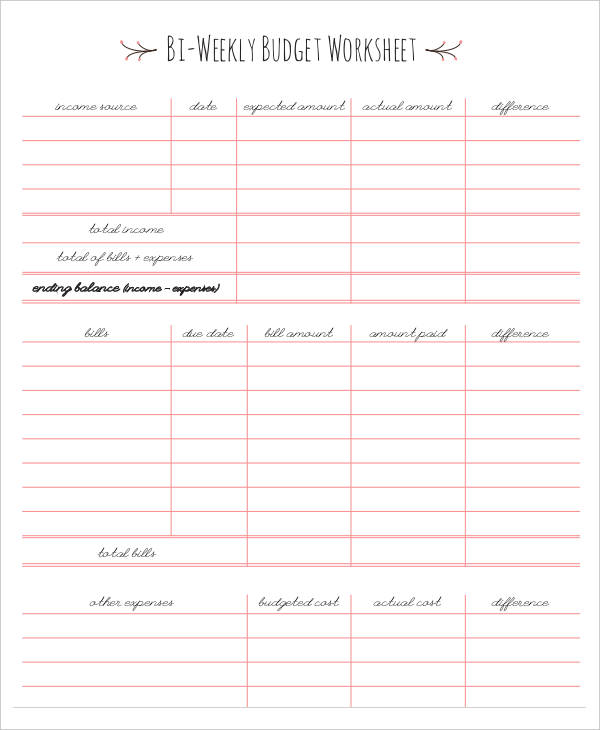

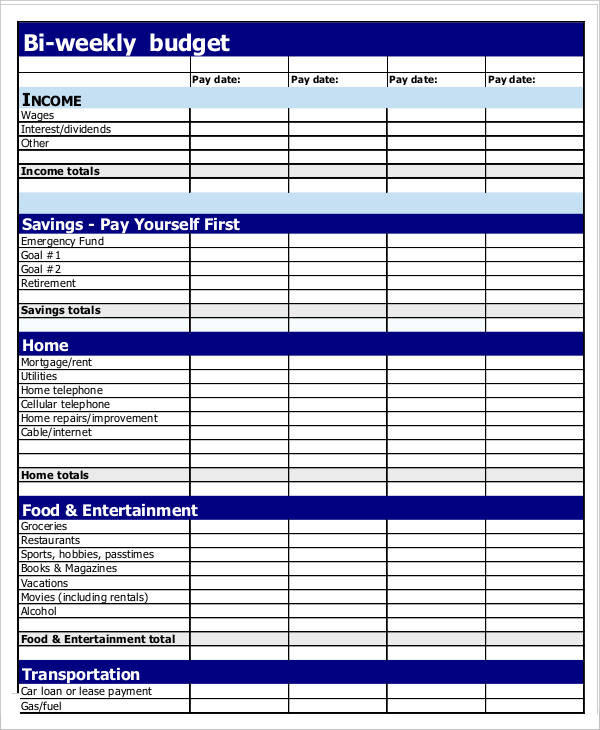

Biweekly Budget Template 8 Free Word Pdf Documents Download Free Premium Templates

Monthly Amortization Schedule Excel Download This Mortgage Amortization Calculator Template A Amortization Schedule Mortgage Amortization Calculator Mortgage

Free Google Docs Budget Templates Smartsheet Personal Budget Template Budget Spreadsheet Template Monthly Budget Template

Biweekly Budget Template 8 Free Word Pdf Documents Download Free Premium Templates

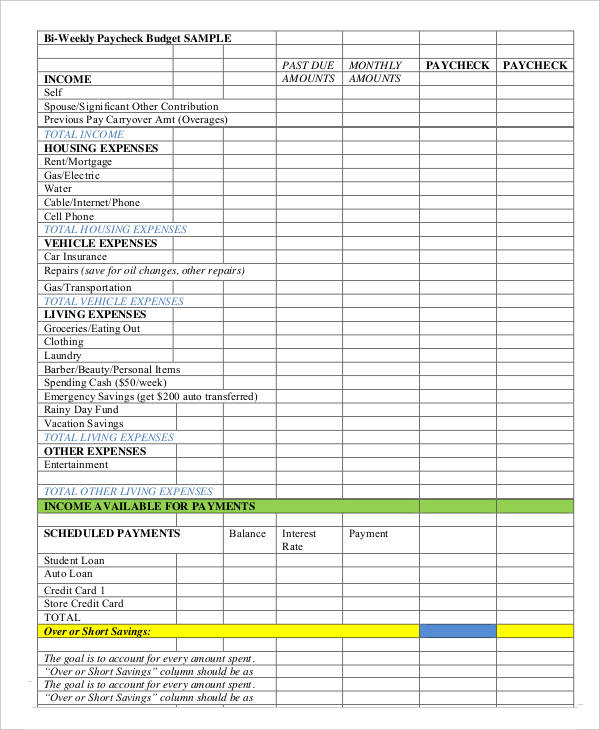

Paying Bills Bi Weekly Using A Budgeting Spreadsheet Budget Spreadsheet Paying Bills Budgeting

Cti First Time Home Buyer Certificate Classes August 2013 First Time Home Buyers Home Ownership Home Buying

Loan Amortization Schedule For Excel Amortization Schedule Mortgage Payment Mortgage Payment Calculator

Making A Budget Spreadsheet Budgeting Worksheets Budgeting Money Budget Planning

Sample Of Excel Spreadsheet With Data Excel Spreadsheets Templates Excel Spreadsheets Spreadsheet Template

22 Printable Budget Worksheets Printable Budget Worksheet Budgeting Worksheets Free Budgeting Worksheets

Biweekly Budget Template 8 Free Word Pdf Documents Download Free Premium Templates

Monthly To Biweekly Loan Payment Calculator With Extra Payments Loan Mortgage Repayment Calculator Payment

Biweekly Mortgage Calculator With Extra Payments Free Excel Template Excel Templates Mortgage Payment Calculator Mortgage

Budget Tracker Template Lovely 12 Free Marketing Bud Templates Marketing Budget Budget Spreadsheet Budget Template

Biweekly Budget Template 8 Free Word Pdf Documents Download Free Premium Templates

Pin On Money Things